How to Find Interest Rate on Excel?

Are you looking for guidance on how to find the interest rate for a loan or investment on Microsoft Excel? This article is for you. Excel is a powerful program that you can use to manage your financial data. With its built-in formulas and functions, you can calculate interest rates quickly and accurately. We’ll walk you through the steps to find the interest rate on Excel and how to use the formulas to calculate the interest due. By the end of this guide, you’ll know exactly how to use the program to find interest rates.

Firstly, Open a new Excel worksheet. In cell A1, type “Principal”. In cell A2, type “Interest Rate”. In cell A3, type “Number of Periods”. In cell A4, type “Payment”. In cell B1, enter the principal amount. In cell B2, enter the interest rate as a decimal. In cell B3, enter the number of payments. In cell B4, enter the payment amount.

Next, in cell C4, enter the formula =PMT(B2/12,B3,B1). This formula calculates the payment amount. In cell B4, enter the formula =B1*(B2/12)*(1+B2/12)^B3. This formula calculates the total interest paid.

Finally, compare the value in cell B4 with the value in cell C4. If they match, the interest rate is correct. If not, adjust the interest rate in cell B2 until the values match.

How to Calculate Interest Rates in Excel?

Using Microsoft Excel, you can easily calculate interest rates for different types of investments, loans, and other financial instruments. Whether you need to figure out the rate of return on a loan or the annualized rate of return on an investment, Excel can do the calculations for you. In this article, we’ll explain how to calculate interest rates in Excel and provide some tips and tricks for getting the most accurate results.

To calculate interest rates in Excel, you will need to use the Excel financial functions such as PMT, FV, NPV, and IRR. PMT stands for Payment and is used to calculate the regular payments on a loan. FV stands for Future Value and is used to calculate the future value of an investment. NPV stands for Net Present Value and is used to calculate the present value of a future investment. IRR stands for Internal Rate of Return and is used to calculate the return rate on an investment.

Using these functions, you can easily calculate the interest rate on any type of loan or investment. Excel also provides a range of other features that can be used to calculate interest rates, such as the ability to use the Loan or Mortgage Wizard to calculate the interest rate on a loan, or the ability to use the Interest Rate Calculator to calculate the rate of return on an investment.

Using the Loan or Mortgage Wizard to Calculate Interest Rates

The Loan or Mortgage Wizard is a feature in Excel that allows you to quickly and easily calculate the interest rate on a loan or mortgage. To use the Loan or Mortgage Wizard, you need to enter the loan amount, the term of the loan, and the interest rate. Once you have entered this information, the Loan or Mortgage Wizard will calculate the monthly payments and the total interest cost of the loan.

The Loan or Mortgage Wizard also provides additional features such as the ability to compare different types of loans and mortgages and the ability to simulate different payment scenarios. This can be useful if you want to determine the optimal loan or mortgage for your situation.

Using the Interest Rate Calculator to Calculate Interest Rates

The Interest Rate Calculator is a feature in Excel that allows you to quickly and easily calculate the rate of return on an investment. To use the Interest Rate Calculator, you need to enter the amount invested, the length of the investment, and the rate of return. Once you have entered this information, the Interest Rate Calculator will calculate the annualized rate of return.

The Interest Rate Calculator also provides additional features such as the ability to compare different types of investments and the ability to simulate different investment scenarios. This can be useful if you want to determine the optimal investment for your situation.

Tips and Tricks for Calculating Interest Rates in Excel

When calculating interest rates in Excel, there are a few tips and tricks you can use to get the most accurate results. First, make sure you are entering the correct information into the financial functions. If the information is incorrect, the results will not be accurate. Second, use the Loan or Mortgage Wizard and the Interest Rate Calculator to compare different loan and investment scenarios. This can help you determine the best loan or investment for your situation. Finally, if you are not sure how to use the financial functions, consult the Excel help documentation for more information.

Verifying Results

When calculating interest rates in Excel, it is important to verify the results. This can help you ensure that you are getting the most accurate results. To verify the results, you can use the Excel Solver tool to calculate the rate of return on an investment or the interest rate on a loan. The Solver tool will calculate the rate of return or interest rate based on the input information and allow you to compare the results to the results of the financial functions.

Using Online Resources

If you are having trouble calculating interest rates in Excel, there are a number of online resources available to help. These resources can provide helpful tutorials, calculators, and tips for calculating interest rates in Excel. Additionally, you can use online forums or search engines to find answers to specific questions about calculating interest rates in Excel.

Frequently Asked Questions

Q1. What is an Interest Rate?

An interest rate is the amount charged, expressed as a percentage of principal, by a lender to a borrower for the use of assets. The interest rate is typically noted on an annual basis known as the annual percentage rate (APR). Interest rates can be fixed or variable, depending on the terms of the loan agreement.

Q2. What is the formula for calculating Interest Rate in Excel?

The formula for calculating interest rate in Excel is: rate = NPER(payment, -PV, FV) where NPER is the number of payments, payment is the monthly payment amount, PV is the present value of the loan, and FV is the future value of the loan.

Q3. How do you enter the formula into Excel?

To enter the formula into Excel, you will need to open the spreadsheet program and select a blank cell. Then, type in the formula “=NPER(payment, -PV, FV).” Next, click the cell where you want to display the result and press Enter. This will display the calculated interest rate.

Q4. How do you calculate the monthly payment?

To calculate the monthly payment, you will need to use the PMT formula in Excel. The formula is: PMT(rate, NPER, PV) where rate is the interest rate, NPER is the number of payments in the loan, and PV is the present value of the loan.

Q5. How do you calculate the present value of a loan?

To calculate the present value of a loan, you will need to use the PV formula in Excel. The formula is: PV(rate, NPER, payment) where rate is the interest rate, NPER is the number of payments in the loan, and payment is the amount of each payment.

Q6. How do you calculate the future value of a loan?

To calculate the future value of a loan, you will need to use the FV formula in Excel. The formula is: FV(rate, NPER, payment) where rate is the interest rate, NPER is the number of payments in the loan, and payment is the amount of each payment. The future value of a loan is the amount of money you will have at the end of the loan period after making all the payments.

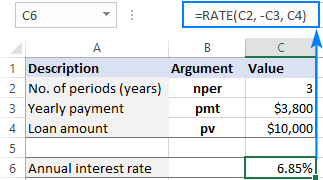

How to Calculate the Interest Rate (=RATE) in MS Excel

Excel is a powerful and versatile tool that can be used to easily find the interest rate. With the right formulas and a few simple steps, you can quickly and accurately determine the interest rate for any loan or investment. By using Excel, you can easily access the data you need to make the best decision for your financial needs. Excel can help you maximize your financial potential, so use it today to find the interest rate you need.