Can You Do Bookkeeping on Excel?

If you’re a business owner, you know how important it is to keep accurate records of your financial transactions. But the thought of doing bookkeeping on Excel can seem daunting. Fortunately, with the right tools and resources, bookkeeping on Excel can be a straightforward and efficient process. In this article, we’ll discuss the basics of bookkeeping on Excel, as well as the benefits and tips for making the process as painless as possible.

Can You Track Bookkeeping in Excel?

Bookkeeping is the practice of recording and tracking financial transactions. It is an essential part of running a business, as it helps you to keep track of your income and expenses. Traditionally, bookkeeping has been done using paper-based systems or specialized software. But can you do bookkeeping on Excel? The answer is a resounding yes! Excel is a powerful tool for tracking and analyzing financial data, and it can be used for some basic bookkeeping tasks.

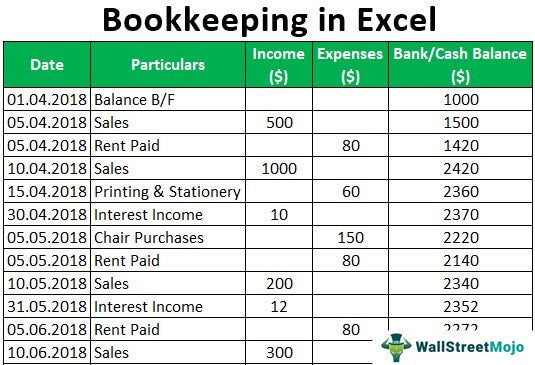

In Excel, you can set up a spreadsheet to track income and expenses with columns for each category. You can then enter data manually or import it from an accounting system. Excel also includes a range of built-in formulas that can be used to calculate totals, analyze trends, and generate reports. This makes it easy to keep an up-to-date record of your financial activity.

There are some limitations to using Excel for bookkeeping. For example, it can be time-consuming to manually enter data, and it can be difficult to keep track of complex transactions. Additionally, it doesn’t have the same level of security and user access control as dedicated accounting software. Despite these drawbacks, Excel can still be used for basic bookkeeping tasks.

Setting Up the Spreadsheet

If you want to track bookkeeping in Excel, the first step is to set up a spreadsheet. This should include columns for each category of income and expenses, such as sales, wages, rent, and utilities. You should also include columns for each date, as well as an additional column for notes. Once you have set up the spreadsheet, you can start entering data.

You can enter data manually or import it from an accounting system. If you are importing data, make sure that the data is in a compatible format and that any currency conversions are done correctly. Once the data is entered, you can use the built-in formulas to calculate totals and generate reports.

Creating Reports

Excel makes it easy to create reports that can be used to track your financial activity. You can use the built-in formulas to calculate totals and generate reports on income and expenses. You can also use the charting features to create graphs that show trends in your financial data.

You can also use Excel to create budget forecasts. This can be done by entering data for projected income and expenses and then using the formulas to calculate totals and generate reports. This is a useful tool for planning for the future and understanding the financial implications of different decisions.

Limitations of Excel

Although Excel can be used for basic bookkeeping tasks, there are some limitations. For example, it can be time-consuming to manually enter data, and it can be difficult to keep track of complex transactions. Additionally, it doesn’t have the same level of security and user access control as dedicated accounting software.

Alternative Solutions

If you are looking for a more sophisticated solution for bookkeeping, there are a number of alternatives to Excel. Dedicated accounting software such as QuickBooks and Xero offer features such as automated data entry, bank integration, and user access control. These systems are more secure and user-friendly, and they can be used to manage complex transactions.

Additional Software

In addition to traditional accounting software, there are a number of other tools that can be used to track financial data. For example, there are apps that can be used to track expenses, generate invoices, and manage customer data. There are also a number of cloud-based solutions that make it easy to share financial data with other users.

Conclusion

Excel can be used for basic bookkeeping tasks, including tracking income and expenses and generating reports. However, it has some limitations and is not as secure or user-friendly as dedicated accounting software. If you are looking for a more sophisticated solution for bookkeeping, there are a number of alternatives to Excel, including dedicated accounting software and other tools such as apps and cloud-based solutions.

Top 6 Frequently Asked Questions

What is Bookkeeping?

Bookkeeping is the process of recording financial transactions in an organized manner. It is the foundation of accounting, and involves the tracking of a company’s income and expenses, which are then used to measure the company’s financial performance. Bookkeeping is traditionally done with paper ledgers and journals, but it can also be done on an electronic platform, such as Excel.

What is Excel?

Microsoft Excel is a spreadsheet program developed by Microsoft and is part of the Microsoft Office suite. Excel is used to store, manipulate, and analyze data in a spreadsheet format. It is a powerful tool for bookkeeping and can be used to track financial transactions, generate financial reports, and more.

Can You Do Bookkeeping on Excel?

Yes, you can do bookkeeping on Excel. Excel is a powerful tool for bookkeeping and can be used to track financial transactions, generate financial reports, and more. Excel can also be used to create budgeting and forecasting models, as well as to store and manipulate data.

What Are the Benefits of Doing Bookkeeping on Excel?

The benefits of doing bookkeeping on Excel include the ability to easily track financial transactions, generate financial reports, and create budgeting and forecasting models. Excel also offers a wide range of features, such as macros, pivot tables, and data validation, which can make the process of bookkeeping more efficient.

What Are the Limitations of Doing Bookkeeping on Excel?

The main limitation of using Excel for bookkeeping is that it does not have the same level of automation as a dedicated bookkeeping software program. Excel is also more prone to errors due to the manual process of entering data, and it is more difficult to track multiple accounts in Excel than in a dedicated bookkeeping program.

What Are Some Tips for Doing Bookkeeping on Excel?

Some tips for doing bookkeeping on Excel include creating a template for entering data, using shortcuts such as Ctrl+F to quickly find information, and using data validation to ensure accuracy. It is also important to regularly back up your data to avoid data loss, and to use the spreadsheet’s built-in formulas and functions to simplify calculations.

Create a Bookkeeping Spreadsheet in Excel in 10 minutes

In conclusion, Excel can be a great tool for bookkeeping for small businesses and start-ups. It is a simple and cost-effective way to keep track of financial information and can be used to generate reports and insights. As with any financial software, it is important to ensure that you understand the features and functions of Excel to get the most out of it. With the right training, Excel can be a powerful and reliable tool for bookkeeping.