How To Do Payroll In Excel Uk?

Are you a UK business owner looking for a way to manage your payroll using Excel? Payroll management is a challenging and time-consuming process, but with the right tools and knowledge, you can easily manage payroll in Excel and save time and money. In this article, we’ll cover the basics of how to do payroll in Excel UK, including setting up your worksheet, calculating earnings and deductions, and generating paystubs. We’ll also provide some helpful tips for payroll management and help you avoid common pitfalls. Whether you’re a small business owner or a large corporation, you’ll find the information you need to get started. Let’s get started!

- Start by entering the employee details such as name, address, tax code, and salary into the spreadsheet.

- Calculate the total amount of income tax and National Insurance Contributions you need to deduct from the employee’s salary.

- Compute deductions for other items such as pension contributions and student loan repayments.

- Calculate the Net Pay for each employee.

- Print payslips for each employee and make sure to keep a digital copy for your records.

You can also use payroll software to automate the calculations and manage your payroll. It can save you time and money, and make the payroll process easier.

How to Do Payroll in Excel UK?

Payroll is a complex process, and it is essential to ensure accuracy and compliance with the relevant regulations. In the UK, it is important to keep payroll records, including employee pay and deductions, and to file PAYE returns, as directed by HMRC. Microsoft Excel is a powerful and versatile tool that can help to streamline the payroll process and ensure accuracy.

This article will explain how to use Microsoft Excel for payroll in the UK. It will cover how to set up the spreadsheet, enter data and calculate payments, as well as how to use formulas, functions and features to ensure accuracy and streamline the process. Additionally, it will provide tips and advice on best practices and compliance requirements.

Step 1: Setting Up the Spreadsheet

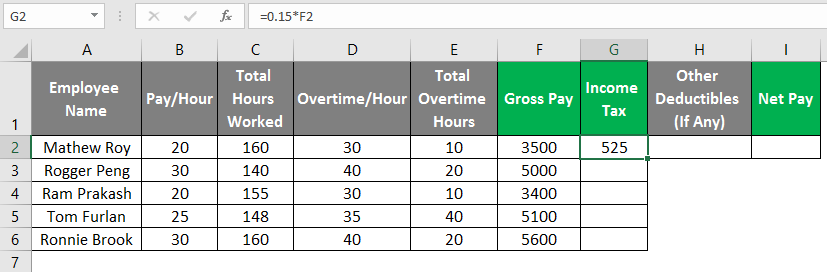

The first step in the process is to set up the spreadsheet. This involves creating columns for the data, such as the employee’s name, pay rate, hours worked, deductions, and net pay. It is important to ensure that all columns are properly labeled, and that the data is entered in the correct format.

Once the columns have been set up, the next step is to add any formulas or functions that may be required. This includes calculations such as deductions and net pay, as well as functions such as SUM or AVERAGE. It is important to ensure that the formulas are correctly entered and that the data is accurate.

Step 2: Entering Data

The next step is to enter the data into the spreadsheet. This includes the employee’s name, pay rate, hours worked, deductions, and net pay. It is important to ensure that all data is entered accurately and that all calculations are correct. Additionally, it is important to ensure that any formulas or functions are correctly entered.

Once the data has been entered, the next step is to check that all the calculations are correct. This includes checking that deductions have been correctly calculated and that the net pay is correct. Additionally, it is important to ensure that any formulas or functions are correctly entered and that the data is accurate.

Step 3: Calculating Payments

The next step is to calculate the payments. This includes calculating the deductions and the net pay. It is important to ensure that all calculations are correct and that any formulas or functions are correctly entered. Additionally, it is important to ensure that the net pay is correct and that any deductions are accurate.

Once the payments are calculated, the next step is to check that all the calculations are correct. This includes checking that deductions have been correctly calculated and that the net pay is correct. Additionally, it is important to ensure that any formulas or functions are correctly entered and that the data is accurate.

Step 4: Generating Reports

The next step is to generate reports. This includes creating reports for PAYE returns, employee payments and deductions. It is important to ensure that all reports are accurate and that any formulas or functions are correctly entered. Additionally, it is important to ensure that the data is accurate and that the reports are compliant with relevant regulations.

Once the reports have been generated, the next step is to check that all the calculations are correct. This includes checking that deductions have been correctly calculated and that the net pay is correct. Additionally, it is important to ensure that any formulas or functions are correctly entered and that the data is accurate.

Step 5: Submitting Reports

The final step is to submit the reports. This includes filing PAYE returns and any other reports required by HMRC. It is important to ensure that all reports are accurate and compliant with relevant regulations. Additionally, it is important to ensure that any formulas or functions are correctly entered and that the data is accurate.

Once the reports have been submitted, the payroll process is complete. It is important to ensure that all calculations are correct and that any formulas or functions are correctly entered. Additionally, it is important to ensure that the data is accurate and that all reports are compliant with relevant regulations.

Tips and Advice

There are several tips and pieces of advice that can help to ensure accuracy and compliance when using Microsoft Excel for payroll in the UK. These include:

- Ensure that all columns are properly labeled and that the data is entered in the correct format.

- Check that all calculations are correct and that any formulas or functions are correctly entered.

- Ensure that the net pay is correct and that any deductions are accurate.

- Check that all reports are accurate and compliant with relevant regulations.

- Ensure that any formulas or functions are correctly entered and that the data is accurate.

Features and Functions

Microsoft Excel provides a range of features and functions that can help to streamline the payroll process and ensure accuracy. These include:

- Formulas and functions for calculations such as deductions and net pay.

- The ability to set up columns and enter data in the correct format.

- The ability to check that all calculations are correct and that any formulas or functions are correctly entered.

- The ability to generate reports for PAYE returns, employee payments and deductions.

- The ability to check that all reports are accurate and compliant with relevant regulations.

Conclusion

Microsoft Excel is a powerful and versatile tool that can help to streamline the payroll process and ensure accuracy. This article has explained how to use Microsoft Excel for payroll in the UK, including how to set up the spreadsheet, enter data and calculate payments, as well as how to use formulas, functions and features to ensure accuracy and streamline the process. Additionally, it has provided tips and advice on best practices and compliance requirements.

Frequently Asked Questions

What is Payroll in Excel UK?

Payroll in Excel UK is a software that can be used to manage payroll and employee data in the United Kingdom. It simplifies the process of managing and tracking employee data, allowing companies to quickly and easily manage payroll and employee records. Payroll in Excel UK is a secure, cloud-based system that allows users to access their data from any device, anytime and anywhere.

Payroll in Excel UK is an ideal tool for small businesses and startups as it allows them to manage their payroll and employees quickly and easily. The software allows users to track employee hours, calculate employee wages, and manage employee leave, pensions, and other employee benefits. Additionally, Payroll in Excel UK can be used to generate reports and manage employee payroll deductions.

How Does Payroll in Excel UK Work?

Payroll in Excel UK works by creating a secure, cloud-based system for managing and tracking employee data. The software allows users to access their data from any device, anytime and anywhere. The software is designed to make the process of managing and tracking employee data as simple and straightforward as possible.

Once the user has logged in to their account, they can enter their employee data, such as their hours worked, wages, and any other employee benefits. The software then calculates the employee’s wages and deductions, and generates a report that can be printed or emailed to the employee. Additionally, the software can be used to manage employee leave, pensions, and other employee benefits.

What Are the Benefits of Using Payroll in Excel UK?

The primary benefit of using Payroll in Excel UK is the ability to quickly and easily manage payroll and employee data. The software allows users to track employee hours, calculate employee wages, and manage employee leave, pensions, and other employee benefits. Additionally, the software can be used to generate reports and manage employee payroll deductions.

Another benefit of using Payroll in Excel UK is the secure, cloud-based system that allows users to access their data from any device, anytime and anywhere. Additionally, the software is designed to be user friendly, making the process of managing and tracking employee data simple and straightforward. Finally, the software is incredibly affordable, making it ideal for small businesses and startups.

How Can I Get Started with Payroll in Excel UK?

Getting started with Payroll in Excel UK is easy. All that is required is a valid email address and a password. Once the user has logged in, they can enter their employee data and the software will calculate the wages and deductions. Additionally, the software can be used to generate reports and manage employee leave, pensions, and other employee benefits.

Once the user has entered their employee data and the wages and deductions have been calculated, they can then print or email the report to the employee. The user can also set up automatic payments, allowing the wages and deductions to be automatically calculated and paid out.

What Support Does Payroll in Excel UK Provide?

Payroll in Excel UK provides a range of support services to help users get the most out of the software. The software has an online help centre that contains a range of helpful guides and tutorials. Additionally, the software has a dedicated customer service team that is available to answer any questions or queries that users may have.

The software also has an active user community where users can ask and answer questions about the software. This allows users to benefit from the experiences of other users, and helps to ensure that the software is being used correctly. Finally, the software has a range of resources and tools that can help users to get the most out of the software.

How to prepare a Payroll in Excel

Doing payroll in Excel UK is a great way to save time and money while still providing accurate and up-to-date payroll information. By following the steps outlined in this article, you can quickly and easily set up an Excel spreadsheet to manage your payroll. With a few clicks of the mouse, you can have payroll information organized in an easy-to-understand format. By utilizing the power of Excel, you can save time, money, and frustration in the long run.